Buying cryptocurrency with a debit card is one of the fastest and easiest ways to get started in the crypto world. Whether you’re a newbie or a seasoned trader, the ability to buy and send Bitcoin instantly, Ethereum, or any other coin using your debit card can be a game changer. But how exactly does it work? And what should you watch out for to make sure your purchase is smooth, safe, and cost-effective? In this article, I’m going to walk you through everything you need to know about buying crypto instantly with a debit card—from setting up your wallet, picking the right platform, to making your very first purchase. So, buckle up and let’s dive in!

Buying cryptocurrency on peer-to-peer (P2P) platforms has gained massive popularity, especially in countries with restrictive banking or regulatory environments. It’s like meeting a neighbor to buy something directly rather than going to a big store. Sounds convenient, right? But, just like meeting strangers, P2P crypto trading carries some risks you should be aware of before jumping in. Let’s dive into the nitty-gritty of what you might be up against and how to stay safe. Understanding Peer-to-Peer Crypto Trading Peer-to-peer (P2P)

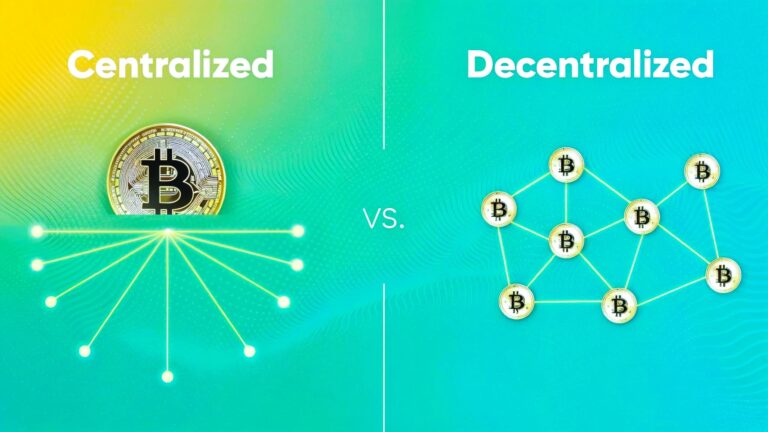

When it comes to trading cryptocurrencies, one of the first things you’ll bump into is the concept of exchanges — but not all exchanges are created equal. The two big players in the game are centralised exchanges (CEXs) and decentralised exchanges (DEXs). Both serve the same basic purpose: letting you buy, sell, or trade cryptocurrencies. But how they do it, who controls them, and how safe they are can be worlds apart. So, what exactly is the difference between centralised

Buying cryptocurrency can feel like stepping into a bustling marketplace, full of exciting possibilities but also potential pitfalls—especially when it comes to fees. Whether you’re a newbie or a seasoned trader, those sneaky high fees can eat into your profits faster than you expect. So, how do you dodge those costly charges and keep more of your hard-earned money? Let’s dive deep, step by step, and uncover the secrets to avoiding high fees when buying crypto. Understanding Crypto Fees: The

Buying cryptocurrency has become easier than ever, but the question many people ask is: Can I buy crypto without ID verification? It’s a hot topic because not everyone feels comfortable sharing personal details online. Plus, the whole KYC (Know Your Customer) process can sometimes feel like a hassle. So, let’s dive deep into this subject, unraveling how buying crypto without ID verification works, where it’s possible, what risks are involved, and what alternatives you might have. What Is ID Verification

When diving into the exciting world of cryptocurrencies, the very first question that often pops up is: Where do I safely buy Bitcoin? It’s like choosing the right marketplace before buying a precious gem — you want to be sure you’re dealing with trustworthy sellers, secure environments, and fair prices. So, what makes a Bitcoin exchange safe? And which platforms stand out in 2025 as the safest places to buy Bitcoin? Let’s unpack all that step by step. Understanding the

So, you’re thinking of diving into the world of cryptocurrency? That’s awesome! Whether you’ve heard about Bitcoin from a friend or stumbled upon Ethereum in your news feed, one thing’s for sure — you’ll need to create an account on a crypto exchange before you can do anything. But don’t worry, it’s easier than it sounds. This guide is your go-to walkthrough for creating a crypto exchange account. We’ll take things step-by-step, cover the ins and outs, and even drop

Have you ever stared at your crypto portfolio and wondered why everything suddenly turned red? You’re not alone. The crypto market has its highs, but the lows — the bear markets — can be brutal. If you’re trying to figure out what causes these long dips, you’re in the right place. Let’s dive into the gritty details and unpack the many layers of a crypto bear market. What Is a Crypto Bear Market? Before diving into what triggers a crypto

Let’s kick things off with the basics. BlackRock isn’t just another finance company—it’s the biggest asset manager in the world. Think trillions in assets, clients across the globe, and influence in nearly every financial market. So when BlackRock makes a move, the world watches. They manage retirement funds, mutual funds, ETFs—you name it. Now they’ve got their eye (and wallet) on Bitcoin. But how deep are they in? The Crypto Awakening on Wall Street Just a few years ago, Bitcoin

Cryptocurrency has taken the world by storm over the past decade, evolving from a niche interest of tech enthusiasts into a global financial phenomenon. Every so often, crypto markets experience dramatic upswings, known as “bull runs,” where prices soar and optimism is sky-high. But is the greatest crypto bull run about to happen? In this article, we’ll break down the indicators, analyze market trends, and explore what might fuel or stall the next big surge. What Exactly Is a Crypto